PRESS RELEASE

March 31, 2020

Shiji Group publishes updates from all industries of Chinese operations to help the international markets build prediction models on the economic recovery post COVID-19 restrictions and crisis.

To assist the international markets build prediction models on the economic recovery post COVID-19 confinements, lockdowns and crisis we are publishing frequent updates from all the industries of Shiji's Chinese operations. We hope this can help management, strategy, marketing and operations teams of the various industries to develop their own plans for recovery and give some points of reference in this unique situation.

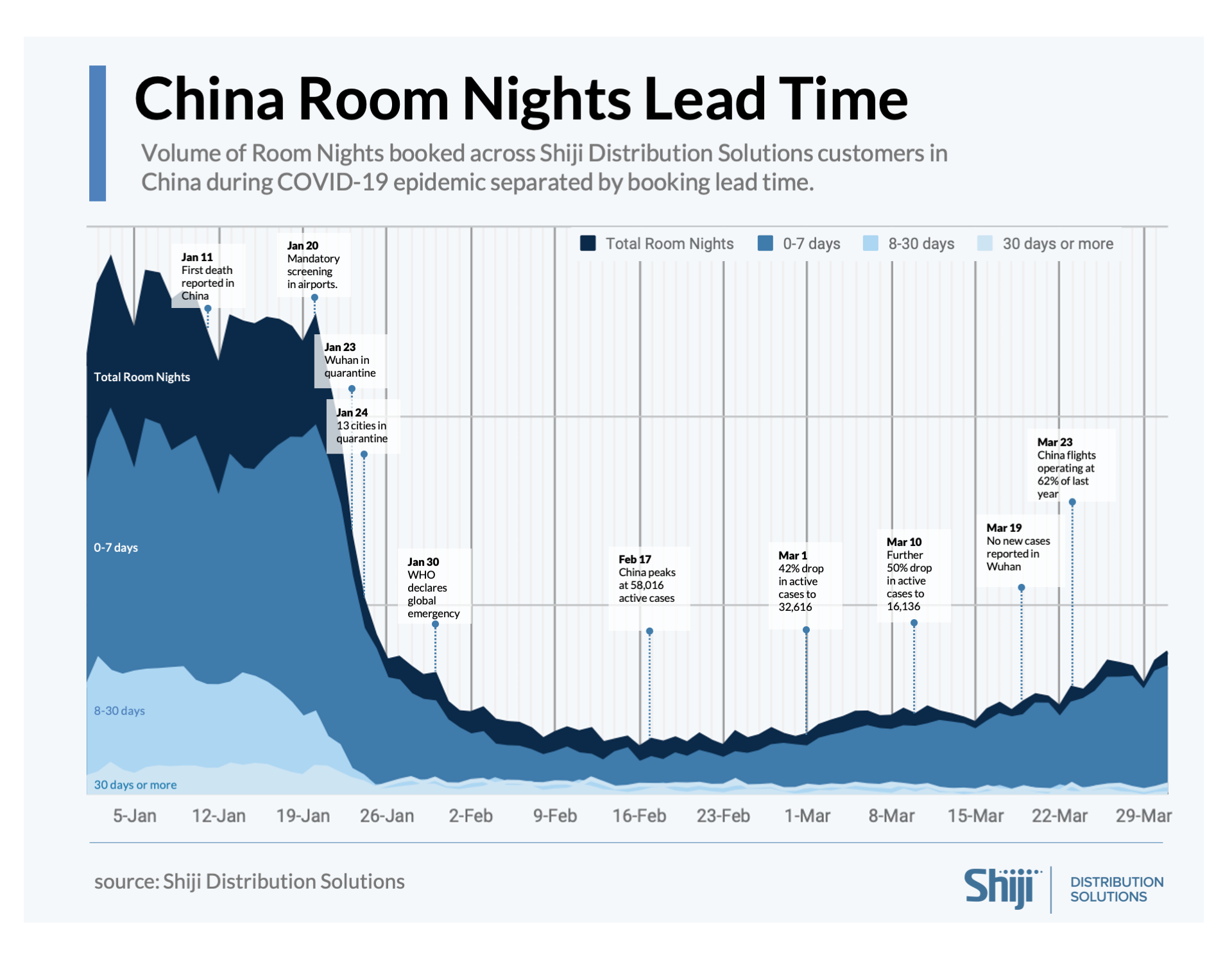

Shiji Distribution Solutions has analysed booking volumes and changes in lead time between booking date and arrival date. This chart shows the curve for quarter one 2020, from 1st January to 31st March.

Shiji Retail unit has provided data on the number of retail outlets open for business in China per region. This data shows how small businesses are re-opening their stores to begin selling again. Two thirds (66%) of all Chinese small retail outlets are open for business again.

• Hubei (the region of Wuhan) has the lowest open rate but has been rebounding the fastest with 24% of stores re-opening in the last 10 days.

• Lowest open rate was reached two days before China peaked in number of active cases on Feb 17th.

• Bigger cities have been slightly less affected but are also slightly slower at rebounding.

Shiji Payment Services published the number of payment transactions processed across China. The approximate breakdown of the payment transactions are 65% food and beverage, 10% hotel transactions and 25% Retail transactions. This chart compares the number of transactions as well as the monetary value.

• Number of transactions started to increase the day after retail outlets began opening again on 9th Feb, which was 8 days before peak virus outbreak.

• As of 19 March revenue has reached 39% of the prior pre-crisis daily average. Number of transactions are at 34%.

• Recovery is slowly accelerating with 12.3 points in last 10 days vs. 3.3 points the 10 days before.

Shiji Distribution Solutions published the booking pace per day from the beginning of the year (before the lockdowns) with the key events noted to illustrate at what point the reservations begin to pick-up again after downturn. Looking at the room nights booked index compared to the prior year as the reference point.

• From peak, to lowest point the loss is 127.56 index points.

• The recovery, although slow, began immediately after China reached their highest infection rate on February 17th.

• In the 27 days since, we’ve seen an index growth of 12.03 points (8,5% growth compared to pre-crisis average).

Note: This chart has a logarithmic vertical scale.

Click below to find out all the ways Shiji can help your hospitality, food service, retail, or entertainment business thrive.